kern county property tax payment

A day at wwwkcttccokerncaus A convenience fee will be charged on all card usage. Send payments via mail to KCTTC Payment Center PO.

Campaign Toolkit United Way Of Kern County

The Kern County Auditor-Controllers Property Tax section is currently in possession of Unclaimed Property Tax Refunds generally resulting from roll corrections or cancellations.

. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. A 10 penalty is. Box 541004 Los Angeles CA 90054-1004.

This site has been developed as a convenience to those who are interested in viewing the status of property tax payments and assessments. 10 or it will become delinquent. Child Abuse or Neglect.

Request a Value Review. Press enter or click to play code. Kern County Treasurer and Tax Collector said that the first installment of Kern County property tax will become delinquent if not paid by 5 pm.

Crime Non-Emergency Domestic Violence. On Friday December 10th 2021. Box 541004 Los Angeles CA 90054.

Please type the text from the image. Sangamon County Property Information Line - Ph. Postal Service determines the payment date.

Property Tax and E-Payment Information. An Important Message for Owners of Secured Property. 10 a press release from Kern County Treasurer and Tax Collector Jordan Kaufman said.

Look up your property here 2. With easy access to tax sale information and auction results you can research properties and enter bids from anywhere in the world. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

Select the property VIEW DETAILS link. DeedAuction is part of our offices. Please select your browser below to view instructions.

The postmark of the US. Get Information on Supplemental Assessments. File an Assessment Appeal.

You can mail your payments to the Kern County treasurer and tax collector at. Box 541004 Los Angeles CA 90054-1004. Payment by Visa Mastercard American Express and Discover Card is accepted online 24 hr.

Visit Treasurer-Tax Collector for more information. The first installment is due on 1st November with a payment deadline on 10th December. Property Taxes - Pay Online.

Please write ATNs on your check. When paying by mail include the payment stubs with your check. Fraud Waste and Abuse in Kern County Government.

See detailed property tax information from the sample report for 10804 Thunder Falls Ave Kern County CA. Payments can be made on this website or mailed to our payment processing center at PO. The Kern County Treasurer and Tax Collector KCTTC is reminding Kern residents that the first installment of property tax is due next weekThe county agency is urging residents to make sure they pay the first installment of their property tax by 5 pm.

Secured tax bills are paid in two installments. The median property tax on a 21710000 house is 160654 in California. Installment Payments Make a payment on a traffic criminal or juvenile dependency case that was previously set up on a payment plan.

Payment by Visa MasterCard American Express Discover Card and Electronic Checks is accepted through the Kern County Treasurer and Tax Collectors website. Kerr County Tax Office Phone. To avoid a 10 late penalty property tax payments must be submitted or postmarked on or before Dec.

This unclaimed money consists of Property Tax refunds that require a claim form be submitted prior to the issuance of a warrantcheck. The owner search is the best way to find a property. Property taxes for the second installment of the secured tax bill are now payable and will become delinquent in 51 days.

Welcome to the Sangamon County Property Tax and E-Payment Information webpage. Start by looking up your property or refer to your tax statement. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County.

Proposition 13 - Article 13A Section 2 enacted in 1978 forms the basis for the current property tax laws. Please enable cookies for this site. File an Exemption or Exclusion.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. Property Taxes - Pay by Wire. The median property tax on a 21710000 house is 227955 in the United States.

Search for Recorded Documents or Maps. Welcome to the Kern County online tax sale auction website. The median property tax on a 21710000 house is 173680 in Kern County.

Cookies need to be enabled to alert you of status changes on this website. Search for your property. Change a Mailing Address.

Find Property Assessment Data Maps. Purchase a Birth Death or Marriage Certificate. KCTTC Payment Center PO.

You can also pay online. This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property.

2 1 1 Kern County United Way Of Kern County

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

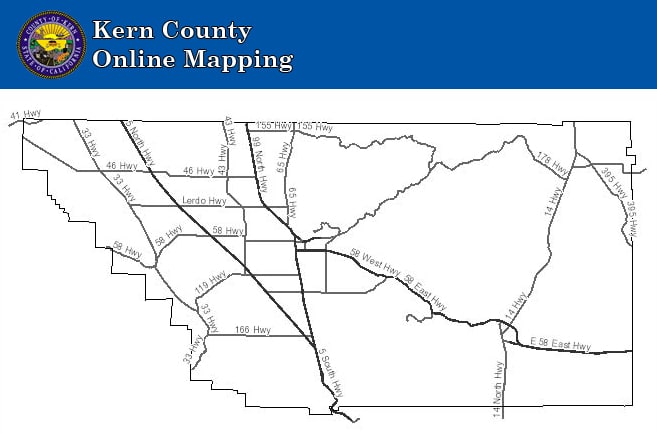

Interactive Maps Kern County Planning Natural Resources Dept

Kern County Map Kern County County Map Kern County California

Home Water Association Of Kern County

Supervisorial District 4 Map Kern County Ca

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Property Taxes Due Next Week Kget 17

A California County That S Making Good News Area Development

Housing Authority Of The County Of Kern Creating Brighter Futures One Home One Family At A Time

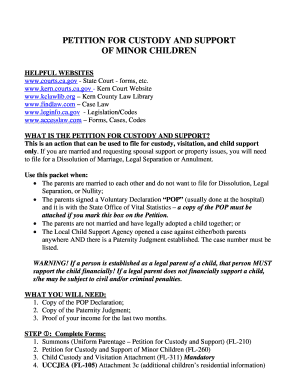

Kern County Court Forms Fill Online Printable Fillable Blank Pdffiller

Kern County Treasurer And Tax Collector

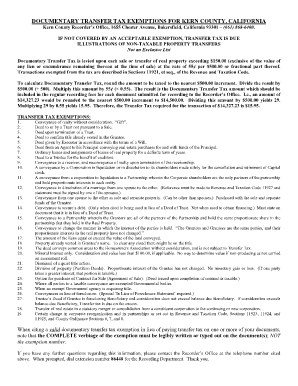

Kern County Grant Deed Form Fill Online Printable Fillable Blank Pdffiller

Kern County California Genealogy Familysearch

Kern County Property Tax Exemption Fill Online Printable Fillable Blank Pdffiller